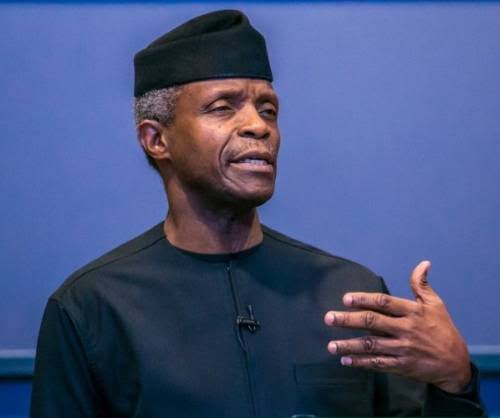

According to report reaching oyogist.com, Vice President Yemi Osinbajo has disclosed that the Federal Government will soon impose heavy tax on giant technology and digital companies in Nigeria.

Osinbajo said the Federal Government will utilize its legal provisions to collect taxes on profits made in the country by global technology and digital firms not based in the country, but with significant economic presence.

He disclosed this during an interactive session with a delegation of the Chartered Institute of Taxation of Nigeria, CITN, led by its President, Mr Adesina Adedayo at the Presidential Villa on Friday and was contained in a statement by his spokesman, Laolu Akande.

Osinbajo, however, assured Nigerians that government would not be increasing tax any time soon.

The statement reads partly: “While the Federal Government will not be raising tax rates at this time, based on the Finance Act 2019, it is already empowered to widen the tax net, including by collecting taxes on the Nigerian income of global tech giants with significant economic presence here, even if they have not established an office or permanent establishment and are currently not paying taxes in Nigeria.

“In this regard, Section 4 of the Finance Act 2019, provides that “the Minister (Finance) may by order (of the President) determine what constitutes the significant economic presence of a company other than a Nigerian company.

“We have had severe economic downturns which of course implies that we may not be able to collect taxes with the aggressiveness that would ordinarily be expected.

“I think the most important thing is that we must widen our tax net so that more people who are eligible to pay tax are paying. Several efforts have been made, and I am sure you are aware of the initiatives including the Voluntary Assets and Income Declaration Scheme (VAIDS) which was also an attempt to bring more people into the tax net, including those who have foreign assets.”

Platforms like Facebook, Twitter, Tiktok will be mostly affected by the new tax imposition when implemented.

These platforms are part of technological companies operating in Nigeria but are located abroad.