According to report reaching oyogist.com, Nigeria’s debt stock of N35.5tn will rise to N42.7tn following the Senate’s approval of the Federal Government’s request for $16bn and €1.02bn fresh loans.

The $16.2bn loan is equivalent to N6.7tn using the Importers and Exporters’ Window exchange rate of N411.24/$1, while the €1.02bn is equal to N485.5bn using the Central Bank of Nigeria’s exchange rate f N476/ €1. These bring the value of the loans to be acquired to N7.2tn.

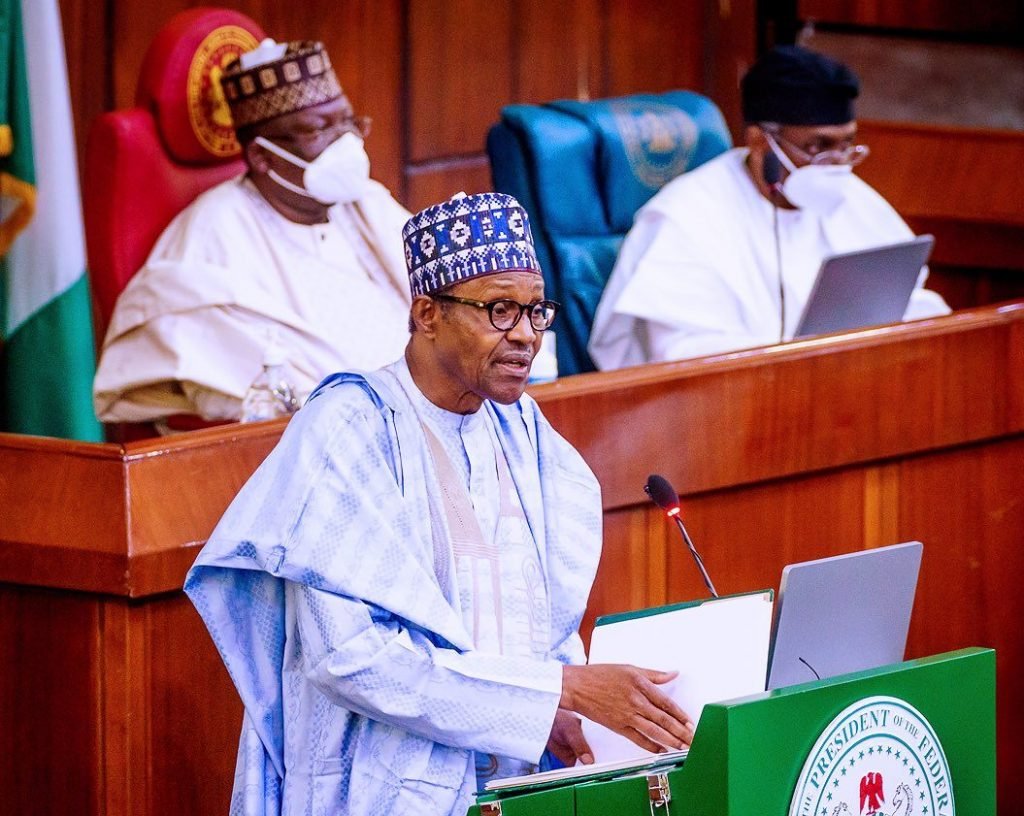

The Senate had on Wednesday approved the foreign loan plans of the President, Major General Muhammadu Buhari (retd.), in which he sought to borrow the sum of $16.2bn, €1,02bn and a grant component of $125m to fund some “legacy projects.”

The Senate also approved the request of the Bank of Industries for the issuance of €500m, but not more than €750m Eurobond in the international capital market.

The red chamber’s approval of the loan requests was, however, accompanied by a resolution that the terms and conditions of the loans from the funding agencies be forwarded to the National Assembly prior to their execution for approval and proper documentation.

The approval followed the consideration of a report by the Senate Committee on Local and Foreign Debt on the proposed 2018-2020 External Borrowing (Rolling) Plan.

The Chairman of the committee, Senator Clifford Ordia, in his presentation, said Buhari’s request was in compliance with the provisions of the Debt Management Office (Establishment) Act, 2003 and the Fiscal Responsibility Act, 2007.

Ordia said the provisions of the statutes enjoined the President to seek and obtain the approval of the National Assembly in respect of the external borrowing programme of the federation and states.

The senator explained that out of the total amount approved by the National Assembly, $3,529,300,000 would be sourced from the World Bank.

He said $5.07bn would be sourced from the China Exim Bank; and $3.9bn from the Industrial and Commercial Bank of China.

Ordia stated that $2.8bn was being expected from the China Development Bank; and $698m from the Africa Development Bank.

He added that €345m was being expected from the French Development Agency; €175m from the European Investment Bank; and $190m from the European ECA/KfW/IPEX/AFC.

The lawmaker also said €500m would be sourced from the international capital market; and $62.1m from Standard Chartered Bank/SINOCURE.