Table of Contents

When withdrawing cash, you’ve likely encountered the common query from POS agents: “Savings or current?” Traditionally, depositing funds in a savings account at a conventional bank yields an average annual interest rate of about 8%, varying by institution. However, Nigerian fintech platforms such as Cowrywise, Piggyvest, Kuda, Fairmoney, and PalmPay now offer significantly higher returns, with interest rates ranging between 14% and 22% per year.

Every savings or loan product is associated with an interest rate-the percentage return determined by the financial service or asset you invest in. Beyond just the interest, each savings app presents unique features and restrictions tailored to different financial objectives and lifestyles. Below is an overview of the top Nigerian savings apps with the most attractive interest rates, alongside their distinctive characteristics.

Top Nigerian Fintechs Offering Superior Savings Interest Rates

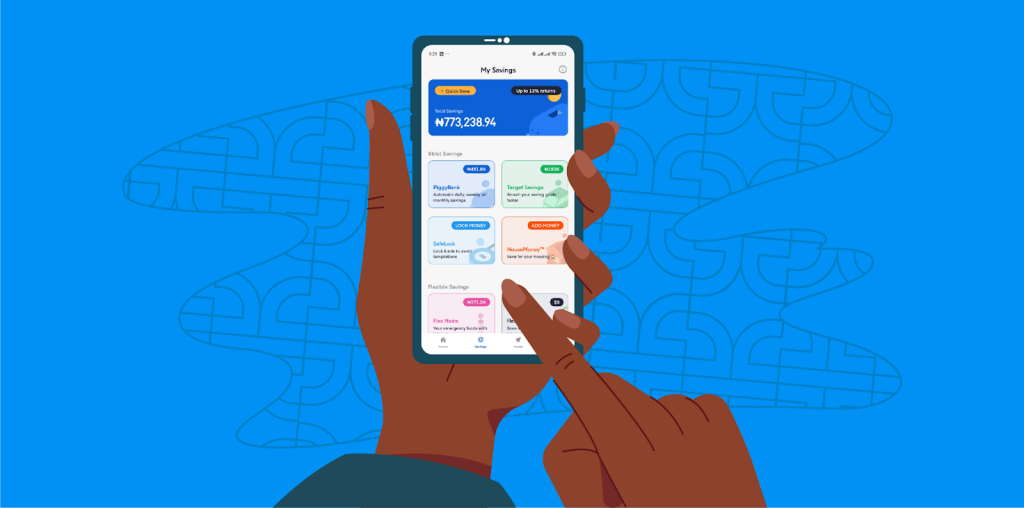

1. Piggyvest: Pioneering Digital Savings Since 2016

As West Africa’s first digital savings platform, Piggyvest offers several savings plans with competitive interest rates:

- Safelock (Fixed Savings): Designed to promote disciplined saving by locking funds for a set period. Interest rates vary from 14% to 20% annually, depending on the lock duration (10 to 365 days). Although you can lock funds for up to 1,000 days, interest on amounts locked beyond 365 days is paid only at maturity.

- Piggybank: Enables automatic savings on a daily, weekly, or monthly basis, with interest accruing daily at 17% per annum. Withdrawals are free once every 90 days.

- Target Savings: Goal-oriented savings with a typical 12% annual interest rate. These can be private or group savings, with a minimum lock period of 30 days. Early withdrawal incurs a 1% penalty and forfeiture of accrued interest.

- HouseMoney: A semi-restrictive plan aimed at saving for homeownership, offering 14% interest per annum. Funds can only be accessed during the maturity month.

Withdrawal Terms: Core savings have strict quarterly free withdrawal windows, and early termination of Safelock or Target Savings results in interest penalties.

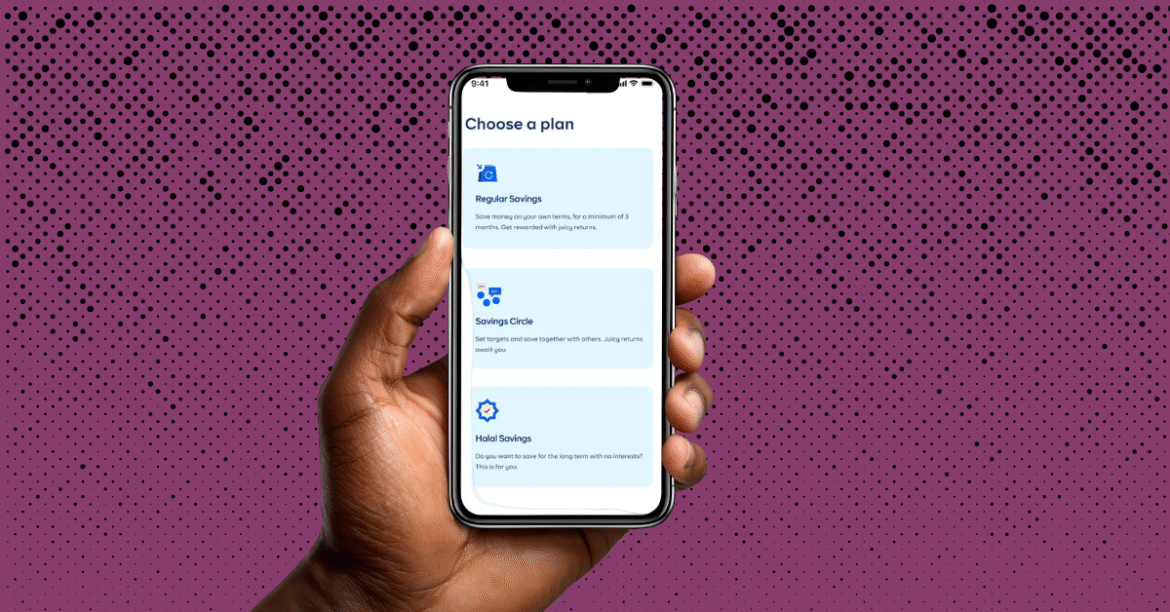

2. Cowrywise: Community-Centric and Goal-Driven Savings

Cowrywise emphasizes social savings and community involvement, offering plans such as:

- Regular Savings/Life Goals: Tailored for specific objectives like emergency funds (13.27% interest), house rent, education, or vehicle purchase plans (13.85% interest). These usually require a minimum lock-in period of three months and are linked to underlying money market funds.

- Money Duo: A collaborative savings plan designed for couples or partners to build wealth together.

- Sports Circles: Innovative savings triggered by real-world events, such as saving money each time your favorite football or basketball team scores, with an average interest rate of 13.27%.

Withdrawal Policy: Fixed plans enforce strict adherence to maturity dates to encourage disciplined saving.

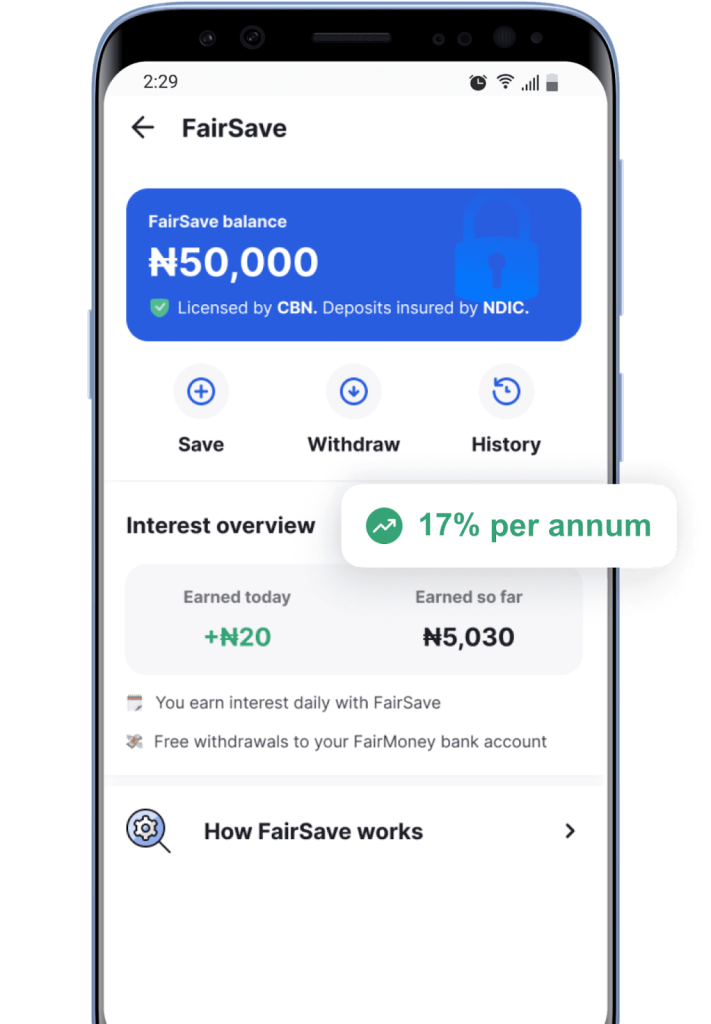

3. Fairmoney: High-Yield Savings with Microfinance Integration

With over ₦35 billion in savings under management, Fairmoney offers two main savings options:

- FairSave (Flexible Savings): Provides high liquidity and competitive interest rates of around 17% per annum, with daily interest accrual.

- FairLock (Fixed Deposits): Offers some of the highest fixed deposit rates in Nigeria, reaching up to 28% annually, ideal for long-term savers.

- Integrated Banking Services: Combines savings with microfinance banking features such as loans and account management for seamless financial operations.

Withdrawal Terms: FairSave allows flexible withdrawals with daily interest, while FairLock deposits mature into FairSave accounts automatically.

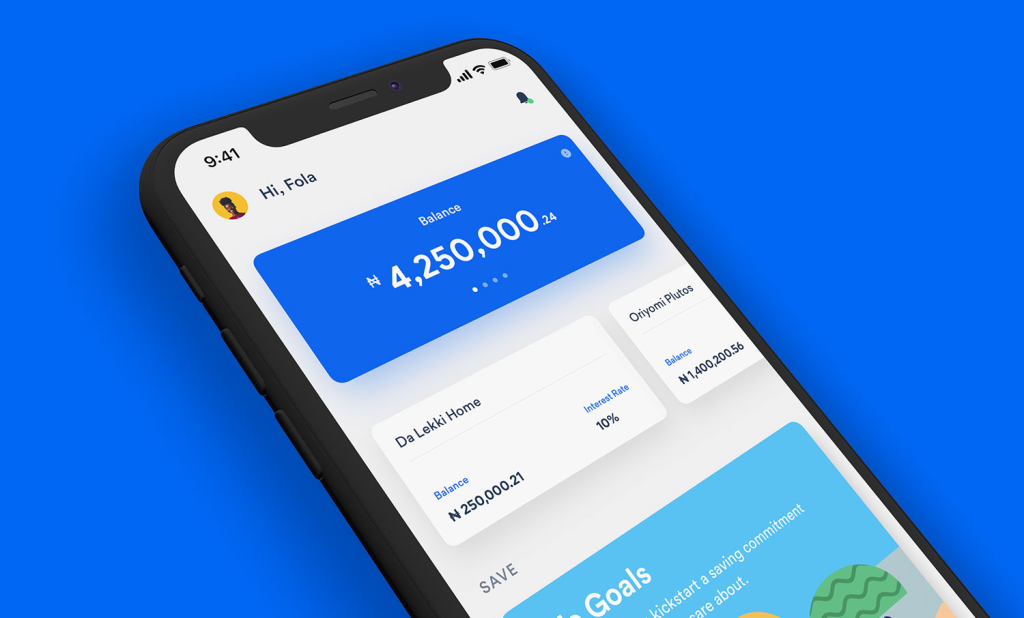

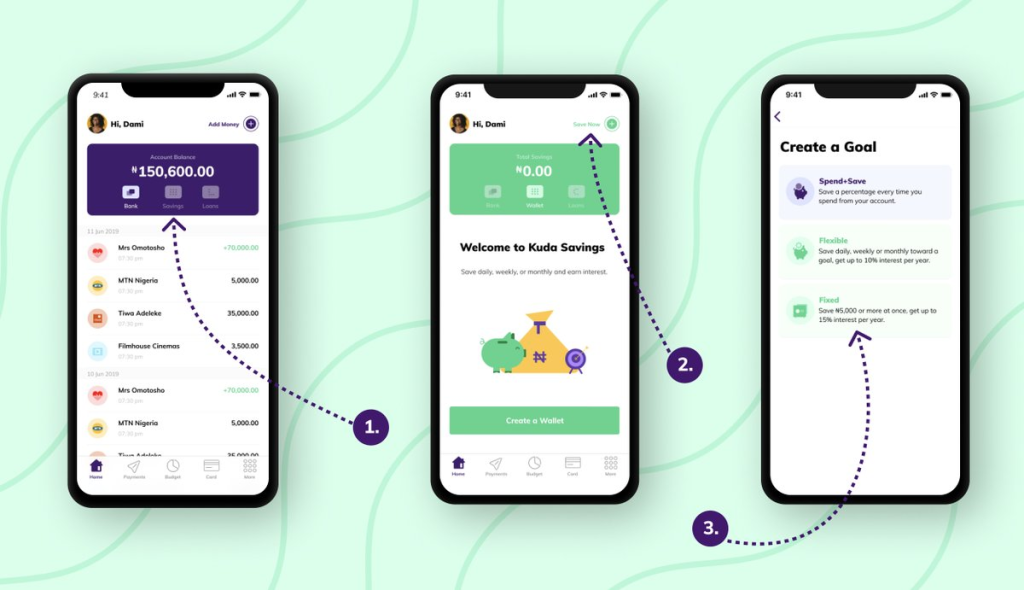

4. Kuda: Automated Savings with Moderate Returns

Kuda’s standout feature is the “Spend+Save” option, which automatically saves a chosen percentage of your spending, though this feature does not earn interest. Other savings options include:

- Save Frequently Pocket: Allows daily, weekly, or monthly savings with interest rates up to 8% per annum.

- Fixed Savings: Offers up to 12% annual interest, with penalties for early withdrawal including a 10% deduction on accrued interest.

Withdrawal Policy: Early withdrawal from fixed savings results in plan cancellation and partial loss of interest.

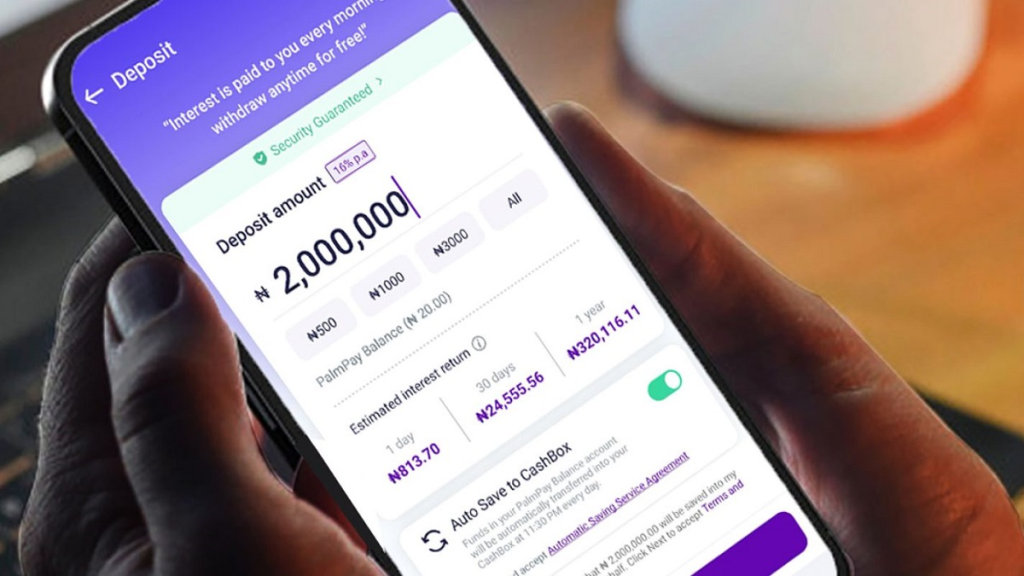

5. PalmPay: High Interest with Instant Access

PalmPay combines attractive interest rates with flexible access:

- Cashbox/SmartEarn: Flexible savings products offering up to 20% and 22% interest per annum, respectively.

- Target Savings: Goal-based savings with 12% interest, customizable frequency, and payout at maturity.

- Spend and Save: Automatically saves a set percentage of every transaction (10%, 50%, 70%, or 100%) into your savings, earning 20% interest annually.

Withdrawal Policy: SmartEarn allows instant, fee-free withdrawals 24/7, providing unmatched liquidity.

| Platform | Piggyvest | Cowrywise | Fairmoney | Kuda | PalmPay |

|---|---|---|---|---|---|

| Main High-Yield Products | Safelock (Fixed Savings), Piggybank | Emergency Funds, House Rent/Study/Car Plans, Sports Circles | FairLock (Fixed Deposits), FairSave (Flexible Savings) | Fixed Savings | SmartEarn, Cashbox (Flexible Savings) |

| Interest Rate Range | 14% – 20% (Safelock) | 13.27% – 13.85% | Up to 28% (FairLock) | Up to 12% | Up to 22% (SmartEarn) |

| Liquidity Level | Low: Quarterly withdrawal windows | Low: Strict maturity adherence | High: Daily interest, flexible withdrawals | Moderate: Automated saving, limited interest | High: Instant, fee-free withdrawals |

| Withdrawal Restrictions | Interest penalty (1%) for early withdrawal | Strict lock-in periods | FairLock matures into FairSave automatically | 10% interest deduction on early withdrawal | No penalties on SmartEarn withdrawals |

How to Select the Ideal Savings Platform for Your Financial Objectives

While fintech savings platforms generally outpace traditional banks in interest rates, your choice should align with your personal financial goals and preferences.

When Piggyvest Is the Best Fit

- Desire for strict savings discipline: Tools like Safelock and HouseMoney enforce mandatory saving habits.

- Comfort with limited liquidity: Quarterly withdrawal windows suit those who can lock funds for set periods.

- Seeking competitive fixed returns: Interest rates between 14% and 20% appeal to savers willing to accept minor penalties for early withdrawal.

Unique Advantage: Piggyvest excels in fostering disciplined saving through structured, fixed-term plans.

When Cowrywise Suits You

- Goal-focused savers: Ideal for those targeting specific life milestones or enjoying community savings dynamics.

- Investment-oriented mindset: Willingness to adhere strictly to maturity dates to maximize returns.

Unique Advantage: Emphasizes social savings and links returns to underlying money market funds for optimized growth.

When Fairmoney Is Your Best Option

- Long-term savers seeking high yields: FairLock offers up to 28% interest, the highest among peers.

- Need for flexible, high-yield accounts: FairSave combines liquidity with competitive daily interest.

- Preference for integrated banking: Access to microfinance services alongside savings.

Unique Advantage: Combines top-tier fixed deposit rates with comprehensive microfinance banking features.

When Kuda Fits Your Needs

- Appreciate automated, passive saving: The “Spend+Save” feature saves a portion of your spending automatically.

- Can commit to fixed terms: Early withdrawals incur interest penalties, so commitment is key.

Unique Advantage: Integrates savings seamlessly into daily spending habits through automation.

When PalmPay Is the Right Choice

- Prioritize liquidity with high returns: Up to 22% interest with instant, fee-free access to funds.

- Enjoy spending-triggered savings: Automatically save a percentage of transactions while earning high interest.

- Value flexible, goal-based saving: Customize savings frequency and goals with payouts at maturity.