Table of Contents

Imagine you’re running low on funds, with payday still a few days or even a week away. You find yourself regretting the jollof rice and ice cream splurge you made just three days after your last paycheck. Suddenly, while scrolling through YouTube, an ad catches your eye:

“Get ₦50,000 instantly! No collateral needed. Low interest rates. Zero paperwork.”

It sounds like a perfect solution, doesn’t it? This is the allure that millions of Nigerians experience with popular loan apps such as Fairmoney, Carbon, and Renmoney, which promise quick loans at seemingly affordable rates.

However, the reality behind the “low 5% monthly interest” claim is often obscured by fine print. The actual cost of borrowing becomes apparent only after the full interest and fees are factored in.

Understanding Interest Calculations and APR in Nigerian Loan Apps

Short-term loans typically come with interest rates applied monthly, representing the extra amount you pay on top of the principal borrowed, usually for durations ranging from a few days up to a month.

For instance, borrowing ₦50,000 at a 10% monthly interest rate means you’ll owe ₦5,000 in interest, totaling ₦55,000 after one month.

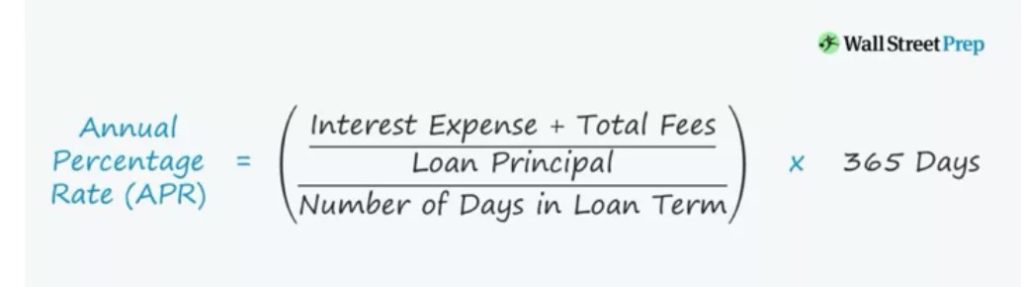

Annual Percentage Rate (APR) provides a clearer picture by expressing the yearly cost of borrowing, including all fees and charges, not just the nominal interest rate.

To calculate APR, lenders take the total cost of the loan (interest plus any fees), divide it by the principal, adjust for the loan term, and then annualize the figure to reflect a yearly rate.

Longer repayment periods increase the total interest paid. For example, borrowing ₦100,000 over 12 months at a 4% monthly interest rate results in a compound APR of approximately 60.1%, with a total repayment amount of ₦160,103.22.

Important note: Some Nigerian loan apps charge exorbitant interest rates even on very short-term loans lasting just 3 to 7 days.

Comparing Interest Rates of Popular Nigerian Loan Apps in 2025

Interest rates vary widely across loan apps, influenced by factors such as creditworthiness, loan amount, and repayment duration. Below is an updated overview of some widely used platforms and their actual costs.

Fairmoney

Fairmoney is a prominent fintech lender in Nigeria, known for quick loan disbursements with minimal documentation and no collateral requirements.

Stated Monthly Interest Rate:

Ranges from 2.5% to 30% monthly, depending on borrower profile and loan term.

Equivalent APR:

Between 30% and 260% annually.

Real User Experience:

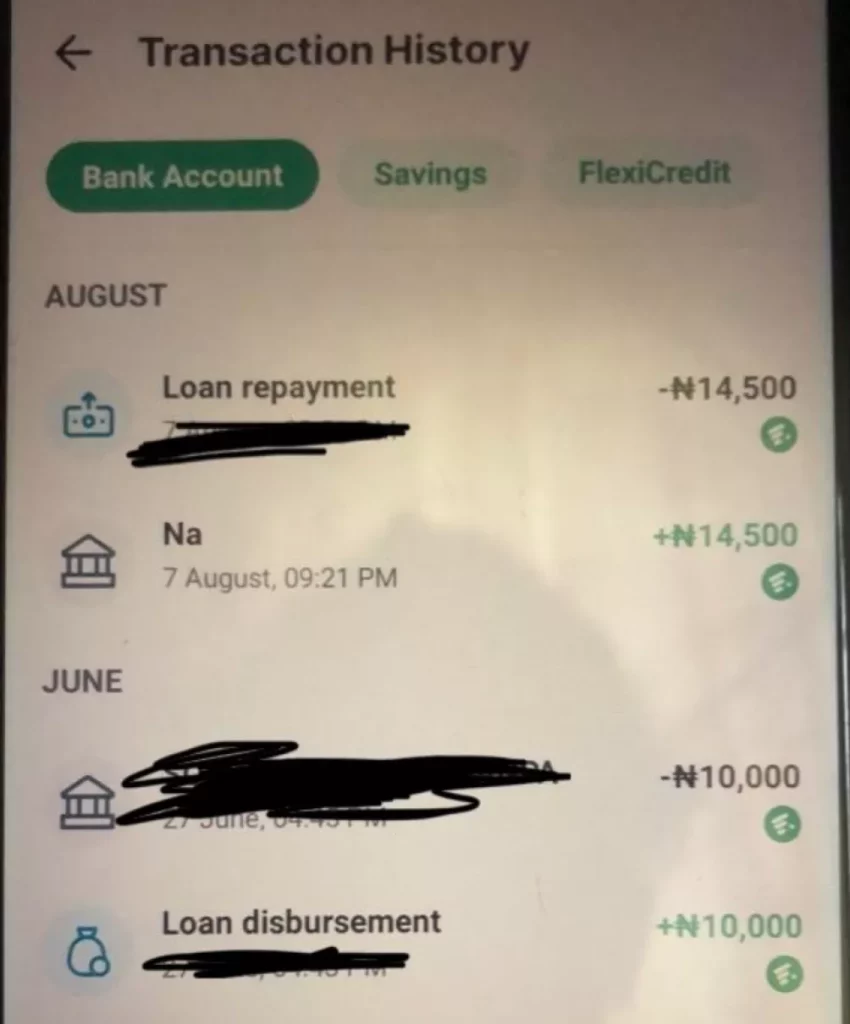

Ayomide* borrowed ₦10,000 and repaid ₦14,500 after 30 days, reflecting a 45% interest rate.

Carbon

Formerly known as Paylater, Carbon offers personal loans with incentives for early repayment, which can reduce interest rates.

Stated Monthly Interest Rate:

Ranges from 4.5% to 30%, decreasing as users build a positive repayment history.

Equivalent APR:

Can reach up to 195% annually for high-risk borrowers.

Real User Experience:

Sobur* took a ₦19,500 loan with ₦4,485 interest, repaying ₦23,985 over three installments in three months. Another user defaulted, and after two years, the debt ballooned to ₦34,370.59 due to accumulated penalties.

OPay (Easemoni)

Easemoni operates within the OPay ecosystem and is backed by Blue Ridge Microfinance Bank, licensed by the Central Bank of Nigeria.

Stated Monthly Interest Rate:

Ranges from 5% to 10% monthly.

Equivalent APR:

Between 60% and 120% annually, depending on loan duration.

Real User Experience:

Temiloluwa* borrowed ₦22,000 and paid ₦4,944 in interest, totaling ₦26,944 after 28 days, equating to a 22.42% interest rate.

In another case, Temiloluwa* took a ₦12,000 loan with ₦5,370 interest, repaid in three installments over three months, resulting in a 44.75% total interest and a 14.9% monthly rate.

PalmPay (Flexi)

PalmPay’s Flexi product, offered through Blooms Microfinance, provides flexible credit options.

Loan Features:

- Flexi Cash: Loans with daily interest rates between 0.6% and 1.5%, with terms from 7 days up to 4 months.

- Flexi BNPL (Buy Now, Pay Later): Allows purchases within the app with zero interest, payable later.

Real User Experience:

Moyo has a ₦16,000 loan due with ₦2,352 interest and ₦1,280 service fees over 21 days, translating to a daily interest rate of 0.70% and a total of 14.7%.

Alex borrowed ₦20,000 for 28 days, incurring ₦5,520 interest, making his total repayment ₦25,520. This equates to a daily interest rate of 0.98% and a cumulative 27.6%.

Final Thoughts: Borrow Wisely to Avoid Debt Traps

While instant loans offer quick relief, they often come with steep costs that can extend repayment over months, complicating your financial health.

To maintain a manageable debt profile, it’s crucial to look beyond flashy advertisements. Always calculate the true APR, compare different lenders, avoid borrowing beyond your means, and steer clear of stacking multiple loans simultaneously.

Remember, the most prudent borrowers are those who pause to assess their repayment capacity before taking on debt.

Keep in mind that interest rates vary widely based on loan amount, duration, and your credit history, so personalized research is essential before committing.