Table of Contents

Nvidia Surpasses Expectations with Record AI Chip Sales Amid Market Uncertainty

By Danielle Kaye, Business Reporter

Nvidia, the semiconductor powerhouse, has once again outperformed Wall Street’s revenue forecasts, alleviating investor concerns about the sustainability of the artificial intelligence (AI) spending surge that has roiled financial markets.

Robust Revenue Growth Driven by AI Data Center Demand

In its latest quarterly earnings report covering the period ending October, Nvidia revealed a staggering 62% year-over-year revenue increase, reaching $57 billion. This surge was primarily fueled by the skyrocketing demand for its AI-focused chips deployed in data centers, with sales in this segment soaring 66% to exceed $51 billion.

Looking ahead, Nvidia projects fourth-quarter revenues to hit approximately $65 billion, surpassing analyst expectations and propelling its stock price up by nearly 4% in after-hours trading.

Nvidia as a Leading Indicator in the AI Revolution

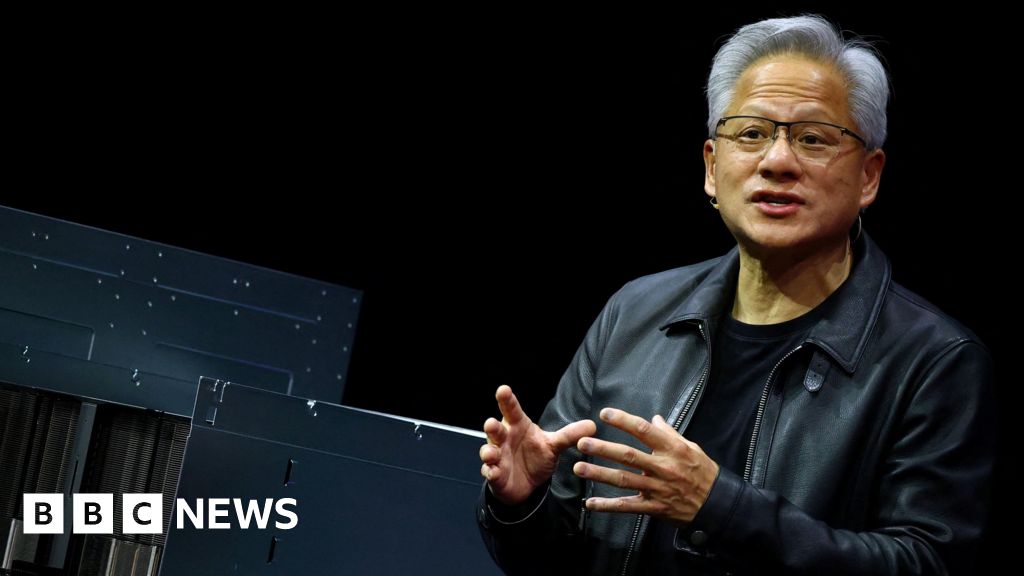

Widely regarded as a bellwether for the AI industry, Nvidia’s financial performance offers critical insight into the broader market’s health amid the AI boom. CEO Jensen Huang described sales of the company’s Blackwell AI systems as “off the charts,” emphasizing that cloud-based GPUs are currently sold out due to overwhelming demand.

Addressing concerns about a potential AI bubble, Huang stated, “From our perspective, the narrative is quite different. We are excelling across every stage of AI development.”

Market Volatility and Investor Sentiment

Despite Nvidia’s blockbuster results, apprehensions about inflated AI stock valuations have persisted, contributing to a four-day decline in the S&P 500 index prior to the earnings release. The index has experienced a nearly 3% drop in November, reflecting investor uncertainty about the return on AI investments.

Adam Turnquist, Chief Technical Strategist at LPL Financial, noted that the key question was not if Nvidia would beat expectations, but by what margin. Similarly, Matt Britzman, Senior Equity Analyst at Hargreaves Lansdown, remarked that while some AI sectors may be overvalued and due for a correction, Nvidia remains a standout exception.

Future Outlook and Regulatory Challenges

Previously, Huang forecasted $500 billion in AI chip orders through the next year, a figure that has investors eager for clarity on revenue timelines and fulfillment strategies. Nvidia’s CFO, Colette Kress, indicated that the company anticipates receiving additional orders beyond this already substantial backlog.

However, Kress expressed frustration over export restrictions limiting Nvidia’s ability to sell chips to China, underscoring the importance of global developer collaboration. She affirmed Nvidia’s commitment to ongoing dialogue with both U.S. and Chinese authorities to navigate these regulatory hurdles.

Strategic Partnerships and Global Expansion

In a significant development at the US-Saudi Investment Forum, Huang and Elon Musk announced plans for a vast data center in Saudi Arabia, with Musk’s AI startup, xAI, as the inaugural client. This facility will be equipped with hundreds of thousands of Nvidia chips, underscoring the company’s expanding international footprint.

According to reports from The Wall Street Journal, the U.S. Commerce Department has reversed a prior decision to allow the sale of up to 70,000 advanced AI chips to government-affiliated entities in Saudi Arabia and the United Arab Emirates. This move followed high-level discussions between former President Donald Trump and Saudi Crown Prince Mohammed bin Salman.

Tech Giants Amplify AI Investments Amid Market Frenzy

Major technology corporations are intensifying their AI expenditures, aiming to capitalize on a sector that has propelled stock valuations to unprecedented levels. Recent earnings from Meta, Alphabet, and Microsoft have highlighted the massive capital outlays for infrastructure, including data centers and semiconductor chips.

Alphabet CEO Sundar Pichai described the AI investment surge as an “extraordinary moment” but cautioned about some “irrational exuberance” in the market, echoing concerns voiced by other industry leaders.

Nvidia’s Central Role in the AI Ecosystem

Nvidia’s chips are integral to the AI infrastructure powering companies like OpenAI, Anthropic, and xAI. The company’s $100 billion investment in OpenAI exemplifies the interconnected nature of AI ventures, which has drawn scrutiny for the complex web of mutual investments among AI firms.