Table of Contents

Peter Obi Urges Immediate Suspension of Nigeria’s New Tax Legislation

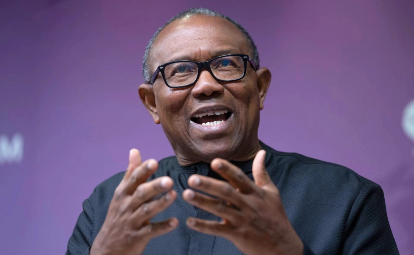

Peter Obi, the Labour Party’s 2023 presidential hopeful and former governor of Anambra State, has publicly demanded that the Federal Government put a halt to the implementation of the recently enacted tax law, which has sparked widespread controversy.

Critical Review Highlights Major Flaws in Tax Law

In a statement released on January 13, Obi emphasized that the recent tax legislation has undergone significant and problematic changes. He referenced an in-depth analysis by global accounting firm KPMG, which uncovered 31 substantial issues within the law. These range from drafting mistakes and conflicting policy provisions to administrative loopholes that could undermine effective enforcement.

Lack of Transparency and Public Engagement

Obi expressed deep concern that such critical shortcomings only emerged following confidential consultations between the National Revenue Service and KPMG. He questioned the accessibility of the tax laws to ordinary Nigerians, stating, “If experts require private sessions to decode our tax regulations, how can the average citizen be expected to comprehend their tax responsibilities?”

Taxation as a Social Contract

Highlighting the broader implications of taxation, Obi described it as more than just a fiscal mechanism-it is a social contract between the government and its people. He argued that this contract cannot be effective if it lacks clarity and public trust.

Globally, tax systems are justified by the tangible benefits they provide, such as enhanced healthcare, quality education, job opportunities, infrastructure improvements, and social welfare programs. Obi stressed that these benefits embody the essence of a social contract.

Concerns Over Nigeria’s Approach to Tax Reform

Contrasting Nigeria’s approach, Obi criticized the government’s apparent focus on maximizing revenue extraction without demonstrating corresponding public benefits. “A tax system devoid of visible returns to the public is not reform-it is exploitation,” he asserted.

Absence of Inclusive Consultations

Obi pointed out that in many countries, tax reforms undergo extensive consultations involving businesses, labor groups, and civil society over extended periods. Citizens are informed not only about their tax obligations but also about the benefits they can expect in return.

In Nigeria, however, such participatory processes were notably absent. The government proceeded with enforcement measures without adequately explaining the new rules or the advantages they might bring, leaving many Nigerians confused and concerned.

Economic Hardships Amid Tax Enforcement

Obi highlighted the timing of the tax enforcement as particularly troubling, given the recent removal of subsidies and the ongoing economic challenges Nigerians face. Rising food prices, increased transportation costs, shrinking purchasing power, and growing poverty levels compound the burden on citizens.

He criticized the government for rushing into a comprehensive tax regime riddled with inconsistencies and flagged by a leading international accounting firm, calling this approach “irresponsible governance.”

Call for Trust, Clarity, and Shared Prosperity

Obi warned that without trust, taxation feels punitive; without transparency, it causes confusion; and without clear public benefits, it amounts to theft. He concluded by urging the government to prioritize open communication, build national consensus, and focus on reforms that foster unity, economic growth, and equitable prosperity for all Nigerians.

As Nigeria navigates these complex fiscal reforms, the need for responsible governance and inclusive dialogue remains paramount to ensure that tax policies serve the people effectively and fairly.