Table of Contents

Table of Contents

- Francophone Africa’s Startup Scene: Unlocking Potential Amidst Challenges

- Cross-Border Innovation: Ghana and Rwanda’s Groundbreaking FinTech Agreement

- Summary of Key Insights

![]()

Greetings!

Welcome to Francophone Weekly by TechCabal, your essential source for in-depth analysis of the technology landscape across French-speaking Africa. While past issues have been accessible online, this newsletter will now be delivered directly to your inbox every Tuesday at noon. The default language is French, but you can easily switch to the English edition by clicking the button below.

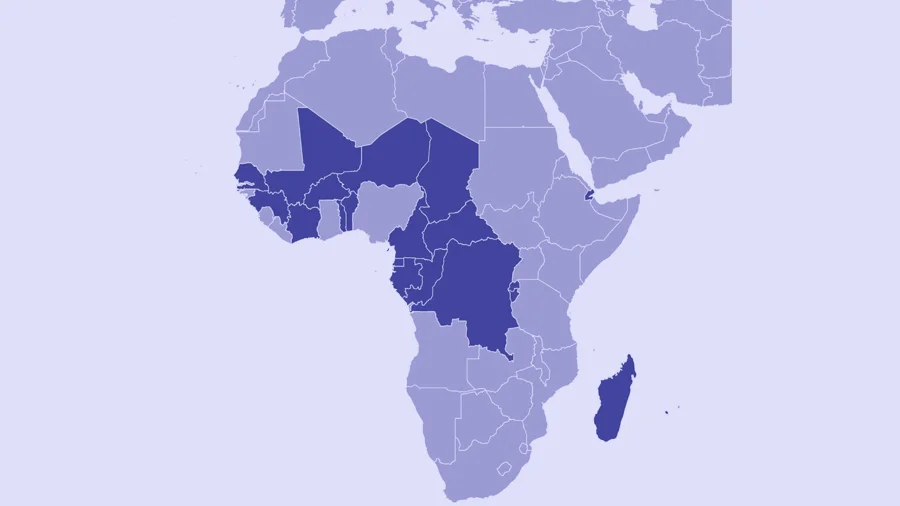

Francophone Africa’s Startup Scene: Unlocking Potential Amidst Challenges

The African startup ecosystem is brimming with promise, and Francophone Africa is rapidly emerging as a hotspot, buoyed by relatively stable currencies compared to other major economies on the continent. However, entrepreneurs in this region continue to grapple with outdated regulations and bureaucratic inertia that stifle progress. For many founders, navigating these systems feels like an uphill battle against frameworks seemingly designed to impede innovation.

Cross-Border Innovation: Ghana and Rwanda’s Groundbreaking FinTech Agreement

A recent landmark development between Ghana and Rwanda is setting a precedent for regional cooperation. At the FinTech Forum held in Kigali, the Bank of Ghana (BoG) and the National Bank of Rwanda (NBR) inked Africa’s first cross-border licensing passport agreement. This pact enables licensed fintech companies in either country to operate seamlessly across both markets with minimal additional approvals. This initiative promises to enhance interoperability and streamline cross-border payments between the two nations.

Let’s delve deeper into the significance of this breakthrough for Francophone Africa and its role in continental payment systems.

1. Monetary Bottlenecks: A Barrier to Financial Fluidity

Image credit: Bloomberg/Getty ImagesIn September, we explored interoperability within the West African Economic and Monetary Union (UEMOA) and the Economic and Monetary Community of Central Africa (CEMAC). Both regions have shown promise but also revealed significant limitations. The Ghana-Rwanda agreement exemplifies a revolutionary regulatory interoperability model that could catalyze growth and attract investment in their respective regions.

Imagine launching a startup in either country with immediate clarity on licensing categories, capital requirements, digital commerce regulations, governance, data policies, outsourcing, and due diligence. For Francophone African countries using the CFA franc, similar agreements could unlock tremendous regional advancement.

To understand the complexity, consider that although the West African CFA franc (XOF) and Central African CFA franc (XAF) are both pegged to the euro and guaranteed by the French Treasury, they are not interchangeable. For example, a product price list from an airline magazine shows prices in XOF, XAF, and euros separately, highlighting subtle but important differences in real value.

Transferring funds between XOF and XAF zones often requires conversion through euros, reminiscent of business travelers in the 1990s who had to route transactions via Paris. This cumbersome process underscores the need for streamlined financial integration.

Challenges Faced by Entrepreneurs

- Excessive Bureaucracy: Company registration is notoriously slow and inefficient, demanding extraordinary patience.

- Inflexible Legal Structures: Traditional frameworks like SARL (Limited Liability Company) and SA (Public Limited Company) impose capital requirements that hinder agile startups.

- Outdated Financial Instruments: Modern funding mechanisms such as SAFEs (Simple Agreements for Future Equity) lack legal recognition, leaving founders in uncertain legal territory.

Addressing these systemic obstacles is critical to fostering an environment where innovation can thrive.

Image credit: The DiplomatistThe regulatory landscape in Francophone Africa is a complex tapestry woven from regional agreements, colonial legacies, and national laws. Central to this framework is the Organization for the Harmonization of Business Law in Africa (OHADA), which unites 17 member states with the goal of standardizing commercial laws.

While OHADA’s mission is commendable, its practical impact on startups is mixed.

- Company Registration: OHADA’s uniform acts aim to simplify business creation, but in reality, the process remains paperwork-heavy and discouraging for entrepreneurs.

- Rigid Legal Forms: The SARL and SA structures are relics that do not accommodate the fast-paced nature of startup growth.

- Limited Recognition of Innovative Financing: Instruments like convertible notes and SAFEs exist in a legal gray area.

The dominance of French civil law further compounds these issues by favoring strict textual interpretation over the flexibility startups require.

3. OHADA’s Dual Role: Harmonizer and Hindrance

Image credit: Maggate Wade/SubstackOHADA’s efforts to unify commercial laws provide two key benefits: legal certainty that facilitates cross-border operations, and an established arbitration system for dispute resolution.

However, its shortcomings are significant. The uniform laws are inflexible and slow to adapt to the rapidly evolving startup ecosystem. Many provisions are outdated, failing to keep pace with technological advancements. For OHADA to truly empower innovation, it must modernize and tailor its regulations to the realities of contemporary entrepreneurship.

4. Financial Constraints: The Investment and Currency Control Challenge

Image credit: CFO.comAccess to capital is vital for startup growth, yet Francophone African entrepreneurs face formidable hurdles akin to running a marathon shackled by chains.

Foreign Capital Restrictions

- Investors must secure approval from regional central banks (BCEAO or BEAC) to transfer funds or repatriate profits.

- Startups struggle to receive foreign currency with ease.

- Popular startup financing tools like SAFEs and convertible bonds lack clear legal frameworks and are often prohibited.

These constraints stifle deal-making, wasting time and resources, and driving away foreign investors. Local investors, familiar with these challenges, tend to shy away from higher-risk ventures.

Venture Capital: A Language Barrier

Venture capital operates with its own terminology-valuation, preferred shares, founder rights, investor protections-but local laws, especially OHADA’s, do not recognize these concepts.

- Key startup terms lack legal recognition.

- Founders cannot offer standard investor protections like liquidation preferences.

- Local registries often reject agreements common in global startup ecosystems.

Consequently, venture capital firms either decline to invest or spend months restructuring deals into outdated formats that weaken founders’ positions.

Legal reforms are urgently needed to align laws with startup realities, providing clear guidance rather than forcing legal contortions.

Banking Sector: An Impenetrable Wall

- Banks demand collateral such as land or buildings, assets most startups lack.

- Interest rates are prohibitively high, and loan approvals are sluggish.

- Even government-backed SME support programs are bogged down by bureaucracy and conservative mindsets.

As a result, many entrepreneurs rely on personal networks for funding, with credit access especially limited for women and young founders. Fintech startups aiming to disrupt this system are themselves hampered by outdated regulations.

Innovation cannot flourish in a banking environment designed solely for traditional enterprises.

Looking Ahead: A Call for Bold Reforms

Francophone Africa faces a critical choice: maintain an outdated monetary orthodoxy or unleash its entrepreneurial economy. Both cannot coexist.

Key reforms to consider include:

- Modernizing currency controls to facilitate early-stage investments.

- Incorporating modern financial instruments into OHADA’s legal framework.

- Empowering development banks to act as catalytic investors rather than debt providers.

- Digitizing approval processes to reduce bureaucratic delays.

- Strengthening regional capital markets like the BRVM (Regional Stock Exchange) to support diverse business growth.

Our ecosystems demand innovation. Markets will thrive when enterprises of all sizes can scale. Without free capital flow, innovation will remain stifled.